Recreational marijuana purchases now subject to selective sales tax in Columbia.

Beginning October 1, purchases of recreational marijuana became more costly in Columbia as the city began to collect an additional 3 percent selective sales tax on those purchases. While the additional sales tax is new, the ability for the city to collect the tax was set in motion in November 2022.

During the November 2022 statewide election, Missouri voters approved an amendment to the state’s constitution that made the use and sale of recreational or adult use marijuana legal in Missouri for adults over the age of 21. The amendment placed a 6 percent state sales tax on purchases of recreational marijuana and authorized local governments to add a 3 percent sales tax if approved by a vote of the public.

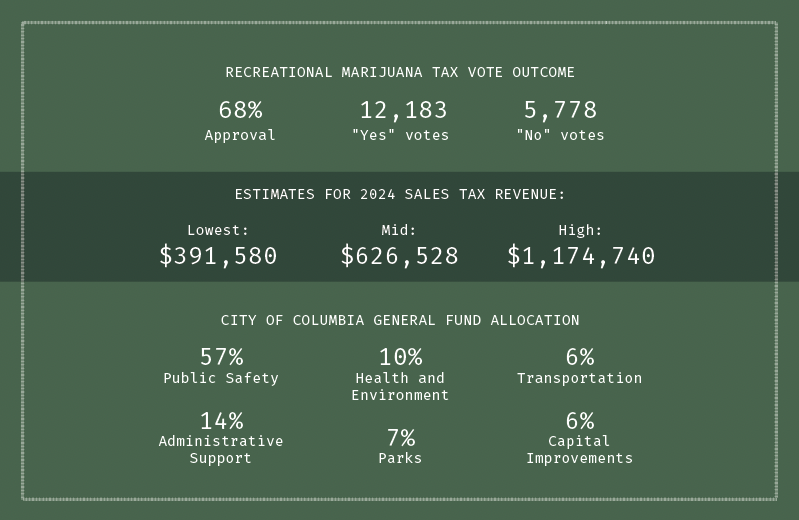

In January 2023, the Columbia City Council unanimously voted to place the additional 3 percent sales tax on recreational marijuana on the April 4 municipal election ballot. On April 4, 2023, Columbia voters passed the the proposed recreational marijuana tax measures, with 68 percent approval. (The outcome for Proposition 1 was 12,183 “yes” votes to 5,778 “no” votes.)

While Columbia voters were voting on the selective sales tax question in April, the April ballot also included recreational marijuana sales tax questions for voters in Boone County, as well as more than 100 other municipalities around the state, including Centralia, Sturgeon, Hallsville, and Ashland. The Boone County tax passed overwhelming with 18,019 “yes” votes and 8,462 “no” votes.

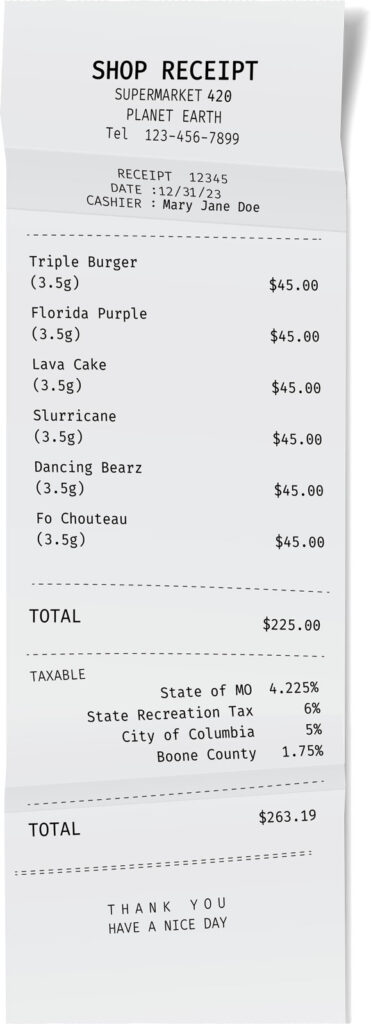

Prior to October 1, recreational marijuana was taxed at 7.975 percent, the same sales tax collected on all goods purchased in, or for delivery to the city of Columbia, explains Matthew Lue, the city’s director of finance.

Lue provided a breakdown of the 7.975 percent sales tax: the city of Columbia receives 2 percent, 4.225 percent goes to the state of Missouri, and 1.75 percent goes to Boone County. The state currently collects an additional 6 percent on purchases of recreational marijuana in Missouri.

With the approval of the ballot initiative, the city now collects the standard 2 percent local sales tax as well as the additional 3 percent selective sales tax on recreational marijuana. It’s important to note that while medical marijuana is subject to local sales tax, it is not subject to the additional selective sales tax.

While recreational marijuana sales and the selective sales tax are new for Columbia, cities around the country have approved similar measures in recent years. Information from the city of Columbia shows that the selective sales tax for Columbia is comparable to other cities around the United States. Examples include Portland, Oregon, East St. Louis, Missouri, and Springfield, Illinois, which all collect a 3 percent recreational marijuana sales tax, and Boulder, Colorado, which collects 3.5 percent.

How Much Additional Revenue Will Be Created?

As recreational marijuana has only been legal in Missouri for a short time, it’s difficult to anticipate the annual sales tax revenue that will result. However, Columbia officials presented three scenarios for potential sales tax revenue for fiscal year 2024 on its the city’s website.

The city estimates that the lowest estimate for sales tax revenue is $391,580 and the medium estimate is $626,528, while the highest estimate is $1,174,740.

Though it’s too early to know exactly how the additional 3 percent tax will affect recreational marijuana sales in Columbia, other cities in the country have implemented similar taxes, and those results have guided the city’s thinking. For instance, according to Columbia officials, Colorado was one of the first states in the nation to legalize the sale of recreational marijuana. The city of Boulder, Colorado collects a 3.86 percent sales tax on all medical and recreational cannabis products, along with an additional 3.5 percent selective sales tax on recreational cannabis.

Because Boulder and Columbia have many commonalities — they’re similar in size and both are home to large universities — trends in cannabis sales tax revenue were used to predict how much revenue a 3 percent selective sales tax in Columbia may generate.

“In Boulder, Colorado, sales tax revenue on recreational marijuana quickly surpassed revenue from medical marijuana and, while there are some important differences, it is not unreasonable to assume a similar trend may occur in Columbia,” Lue says. “Using Boulder as reference, an initial increase of 80 percent in the total demand for cannabis products was forecasted as the median estimate scenario for Columbia. With the segmented tax regime on marijuana, this may come to a total sales tax revenue of approximately $1 million to the city of Columbia for fiscal year 2024.”

Where Does the Money Go?

Though the city can’t say exactly how much revenue will be generated, it knows exactly how the additional funds will be used to benefit the residents of Columbia.

“Once the city begins collecting the additional tax, the funds will be allocated to the city’s general fund activities,” Lue says. “The general fund includes departments such as police and fire, the health department, community development, public works, parks, and other administrative departments.”

Information from the city shows that the general fund is broken down as follows: 57 percent to public safety, 14 percent to administrative support, 10 percent to health and environment, seven percent to parks, six percent to transportation and six percent to capital improvements.

How Will Tax Affect Sales?

After Colorado legalized recreational marijuana in November 2012, Boulder saw a 3.5-fold marijuana-related sales tax increase between 2013 and 2014. Columbia anticipates a lower growth rate, and it provides three estimates for the increase in demand for marijuana for the 2024 fiscal year — the lowest estimate is a 50 percent increase in demand, the medium estimate is an 80 percent increase in demand, and the highest estimate is a 150 percent increase in demand.

Although he says he can’t predict how the additional sales tax will affect sales volume at Green Releaf Marijuana Dispensary at 204 E. Broadway, manager Gunner Millar says demand for recreational marijuana is high. The shop serves up to 900 customers per day, which includes medical and recreational customers.

“It’s probably one of the busier dispensaries I’ve ever been to,” Millar says.

While weekends typically have a higher volume of clients, Millar estimates that Green Releaf serves at least 100 customers per day.

While Columbia residents and government officials watch and wait to see how the additional sales tax on recreational marijuana translates into dollars for the city, the predictions reveal that the payoff could be substantial.

“If trends similar to that of Boulder continue in years beyond fiscal year 2024, then cannabis-related sales tax revenue could grow to around $1.5 to $2 million by fiscal year 2028,” Lue says.

The voter-approved Proposition 1 stipulated that the additional sales tax would go into the city’s general fund, which is available for funding the areas of public safety, administrative support, health and environment, parks, transportation, and capital improvements.