I’ve always thought that I was pretty good with numbers. They just made sense to me. I even liked algebra and geometry. I had a 4.0 in school…until I went to college. That’s where words like debits and credits, ratios, cashflow, projections, and financial statements started being thrown around. I passed Accounting 1 with a B and had absolutely no idea what was going on. We worked in groups together on all our work, and I was certainly the weak link. But somehow, in Accounting 2 it seemed to make more sense. I got an A and thought I was well prepared for all things financial as I went into the business world. Turns out, I think I was just a good test taker.

In my early days of being on boards, I remember getting handed my first set of financials. What were these strange documents with numbers that were supposed to tell me a story? No matter how many times I turned the pages and nodded thoughtfully along with the treasurer explaining them, I never really fully understood them. Not until many years later. It would be a long time before I realized that there was a big difference between basic accounting and finance.

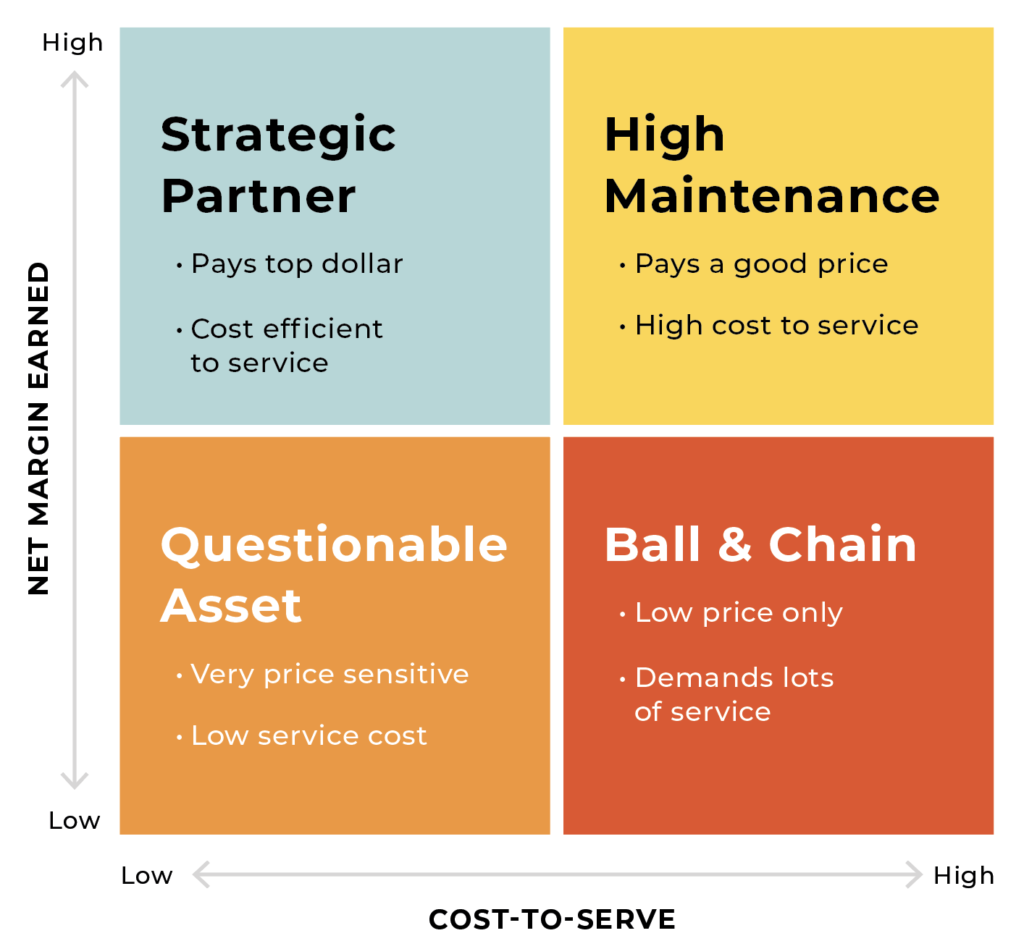

The thing is good cashflow and good sales can cover up a lot of sins. I lived that way for a long time until during the pandemic when our world started shifting. I found myself having to deal with things financially in a very different way. This is the time in my life where I learned that as a business owner, one of the most important relationships you can have is with a local community bank. My bankers personally walked me through understanding what was happening in my business beyond the deposits coming in and the checks going out. They provided suggestions for speeding up my collections on receivables, how to leverage money in a better way, and what expenses might be out of alignment. I started looking at what clients we had that spent a lot of money but took a lot of time and had very low and sometimes non-existent margins. We used the graph shown here to help determine who was a good fit, who needed some training, who needed to grow, and who needed to be moved on to other opportunities.

Lastly, when I brought on new partners last year, one of the amazing gifts that came with that arrangement was Sara Nivens who is a very gifted CFO. She helped me identify further ways in which we were functioning inefficiently financially such as not charging fees to cover credit card expenses. We looked at ongoing subscriptions, bank fees, interest rates, timing of invoicing, timing of statements, and many other things all of which have really sophisticated our processes.

My biggest lessons during these last couple of years have been twofold: you can’t manage business finances like a household budget and you need to surround yourself with people that know more than you. While I don’t see myself ever taking a collegiate math class again, I feel that I may have earned that real life finance degree.