Why does Columbia have so many sales tax rates?

In a modern twist on the historic Boston Tea Party, imagine the banks of the Missouri River near Columbia, Missouri, lit by the glow of a thousand torches as protesters gather to make a bold statement. But instead of crates of tea — they heave cheeseburgers into the murky water. The aroma of sizzling beef mingles with the river breeze as each burger makes a splash, a symbolic act of defiance against alleged injustices of local sales tax.

As the cheeseburgers bob in the gentle current, the crowd chants fiscal fairness and transparency slogans, echoing the spirit of rebellion that once ignited a nation.

That whimsical scenario was inspired by lunch-rush purchases from the eatery with the Golden Arches, making a multitude of fast-food diners wonder why there is a sale tax discrepancy. If you purchase a cheeseburger from McDonald’s on Clark Lane and pay the expected sales tax, you might be surprised to encounter a different tax rate for an identical burger at McDonald’s on Grindstone Parkway.

While the image of cheeseburgers tumbling into the Missouri River may be hyperbolic, it underscores a genuine intrigue: the intricacy of sales tax and its various iterations in Columbia. These deviations are tied to geographically specific community improvement and transportation initiatives, challenging the notion that all taxation is created equal.

The nuances of sales tax and additional special tax districts are intricate. Understanding why sales tax rates may vary between different areas or why seemingly identical goods incur different tax rates is crucial for the empowerment of taxpayers to make informed decisions about their purchases and involvement within voter-approved taxation projects. While the cheeseburger spectacle may be exaggerated, the underlying need for clarity in tax appropriation remains valid.

From Past to Present — Funding Education, Conservation, and More

Missouri’s statewide sales tax began in 1934, encompassing personal property, goods, and services, and has changed over time, with the use tax being instituted later in 1959.

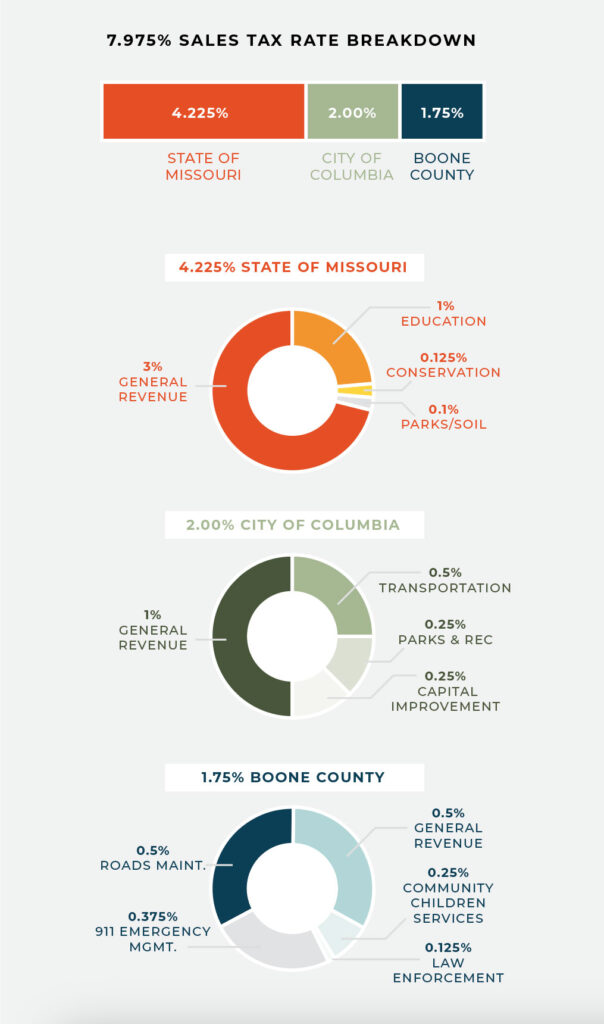

Missouri’s statutes authorize a multifaceted state sales tax that funds key sectors. Three percent supplies general government revenue, 1 percent aids education, one-eighth of 1 percent — 0.125 percent — backs conservation, and .10 percent goes to state parks.

Boone County’s 1.75 percent sales tax provides fundamental services: one-half of 1 percent (0.5 percent) aids county revenue and road maintenance, 0.375 percent is earmarked for 911 services, 0.25 percent (one-quarter of one percent) supports community children services, and 0.125 percent bolsters law enforcement for public safety.

In Columbia, the city sales tax rate of 2 percent, combined with Missouri’s rate of 4.225 percent and Boone County’s rate of 1.75 percent, adds up to 7.975 percent. (To simplify: Every dollar spent generates 7.975 cents of sales tax, or $7.975 per every hundred dollars.) The breakdown highlights the intricacies of civic taxation, which has evolved as consumers face varied local tax rates due to multiple taxation jurisdictions based on address.

Decoding Columbia’s Sales Tax Structure: Unveiling the Financial Framework

Drilling down to the local city level, Columbia’s 2 percent sales tax is, according to city budget planning documents, a strategic commitment fueling the city’s operations across different arenas.

One percent flows into the city’s general revenue fund, feeding principal city services, including the fire department, police, community development, and administrative staff.

Another 0.5 percent supports transportation in Columbia, maintaining and enhancing city infrastructure like roads, bridges, sidewalks, airport, and public transit for safe and efficient travel.

With a focus on enhancing leisure opportunities, a 0.25 percent sales tax allocation supports Columbia’s Park and Recreation Department. That quarter-penny sales tax is divided equally into two categories: permanent and renewable, cumulatively generating $7.2 million annually. The permanent allotment is one-eighth of 1 percent, dedicated indefinitely for the Parks and Recreation yearly operations budget. The remaining one-eight cent is subject to renewal, contingent upon voter approval for capital improvement, green space preservation, and amenity enhancements in parks and recreation areas.

When Columbia shoppers and residents raise their eyebrows or even vocally express frustration with sales tax rates, it’s important to remember that voters have a direct — and final — say in some of those amounts. One case in point: The renewable assignment of the parks tax routinely garners overwhelming approval at the ballot box, with over 80 percent of voters endorsing its continuation on the November 2021 ballot. (As a result, the tax will remain in effect for the next decade, pushing the next sunset or renewal date forward to March 31, 2032.)

A portion of Columbia’s sales tax, precisely 0.25 percent, is dedicated to driving the city’s capital improvement efforts to foster the development of green spaces and architectural advancements. Initially endorsed by voters in 1991, it operates as a temporary sales tax, subject to periodic ballot approvals. The most recent poll ratification came in August 2015, ensuring its extension until December 31, 2025, pending renewal.

Beyond Borders: Exploring Columbia’s Special District Sales Tax

Special tax districts shape Columbia’s monetary landscape with distinct purposes. These districts afford targeted infrastructure within specific geographical boundaries. Typically created to finance services or improvements not covered by general local government funding, these districts operate independently, with their own governing bodies — elected or appointed — separate from the city of Columbia and are customarily ballot-initiated, requiring voter approval.

In Columbia, there are three types of special tax districts: Community Improvement Districts (CIDs), Tax Incremental Financing (TIF), and Transportation Development Districts (TDD). CIDs, creating new political subdivisions within a municipality, exist in Downtown, the North 763 corridor, and the Business Loop, each with an additional 0.5 percent or half-penny tax contributing to transportation infrastructure. Per the Missouri Department of Revenue Tax and Fee Distribution Summary published by the Department of Revenue for fiscal year 2022, $1,119,840 was distributed for these specific CID areas. Additionally, thirteen TDDs throughout Columbia have varying additional tax rates ranging from 0.5 percent to 1 percent.

Columbia also has one TIF district, spanning the downtown area between Providence Road and College Avenue. This district allocates future real property taxes to finance public infrastructure upgrades, such as roads, sidewalks, and similar projects.

Special districts in Columbia go beyond mere geographic boundaries, contributing to the city’s vibrancy and progress. Every purchase plays a role in shaping a brighter future for residents and visitors alike. So, with each burger, we are investing in Columbia’s success.

Community Improvement Districts

| Downtown | 0.50% |

| $769,398 total | |

| North 763 | 0.50% |

| $33,999 total | |

| Business Loop | 0.50% |

| $316,443 total |

Source: Missouri Department of Revenue: FinancialandStatisticalReportFY22.pdf

Transportation Development Districts

| Blue Ridge Town Centre | 1.00% |

| Broadway-Fairview | 0.50% |

| Centerstate | 0.50% |

| Columbia Mall | 0.50% |

| Conley Road | 1.00% |

| Cross Creek | 0.50% |

| Discovery | 1.00% |

| Grindstone Plaza | 0.62% |

| Lake of the Woods | 1.00% |

| Northwoods | 0.50% |

| Rockbridge Center | 0.62% |

| Shoppes at Stadium | 1.00% |

| Stadium Corridor | 0.50% |

Source: City of Columbia como.gov/tax-breakdowns

Flowing Finances: Navigating Columbia’s Sales Tax Currents

In Columbia’s financial topography, sales tax has emerged as a pivotal contributor to solvency, averaging 43 percent of its total revenue over the past decade. Despite a notable expansion in total sales tax revenues from $52,611,482 in fiscal year 2021 to $60,246,376 in fiscal year 2023, expenditures are rising at an even higher margin. According to the latest FY23 annual comprehensive financial report, overall expenses and governmental activities were $146,260,954, compared to the FY21 total of $106,342,141, equating to a 38 percent increase over two years. Utility costs are substantial, representing a smidge more than 10 percent of the total outlays associated with general revenue. Additionally, an escalation in employee wages, driven by the need to maintain competitive market salary parity, dominates the general revenue expenditures, comprising 70.2 percent of total disbursements within this fund.

Source: Infographic created based on data from Missouri Department of Revenue, Sales/Use Tax (mo.gov) , City of Columbia, como.gov/tax-breakdowns and Boone County Boone County Citizens Guide to County Finances 2022 (showmeboone.com)

Matthew Lue, the city’s director of finance, voiced his concern over the litmus test of keeping pace with modestly climbing sales tax collections amid equally escalating inflation implications that influence business and governmental spending. Reflecting on past challenges, Lue highlighted the difficulty and costliness of getting vital equipment during and after the COVID-19 pandemic, citing the example of transformers for housing utility needs, which surged to $6,000 each compared to the current price tag in 2024, of $2,500 per transformer.

“Critical unavoidable equipment transactions during this time frame are sunk costs and have significantly affected fund balances going forward, which we must adjust,” he explained.

Lue continued, “As healthcare and wages escalate nationwide, the pressure to retain talent within operational divisions, emergency services personnel, and police forces intensifies at the local level.” Expanding budgets in line with market demands is further exacerbated by inflationary pressures if sales tax stagnates or fails to keep up. Against that backdrop, sales tax assumes heightened importance in challenging economic circumstances.

Multiple pieces of legislation routinely proposed in the Missouri House and Senate also seek to limit city revenue, posing unique challenges if such bills are passed.

Sales tax is central to Columbia’s growth, driving commercial stimulation. Those revenues fund essential community services and infrastructure, ensuring residents have quality neighborhoods with access to trails, sports facilities, and playgrounds. Lue emphasized that the city remains dedicated to providing these services, regardless of budget constraints or legislative changes, to make Columbia a thriving and desirable place to call home.

What is the bottom line of this somewhat dizzying dive into the local sales tax picture? The next time you contemplate the nature of burger taxation in Columbia, it may be best to resist the urge to toss your lunch into the river, akin to the Boston Tea Party. After all, those burgers are indispensable for keeping the city afloat.

Each bite satisfies your hunger — and contributes to the local economy’s growth. You can indulge in that burger guilt-free, knowing you’re fulfilling your civic duty, one delicious bite at a time.